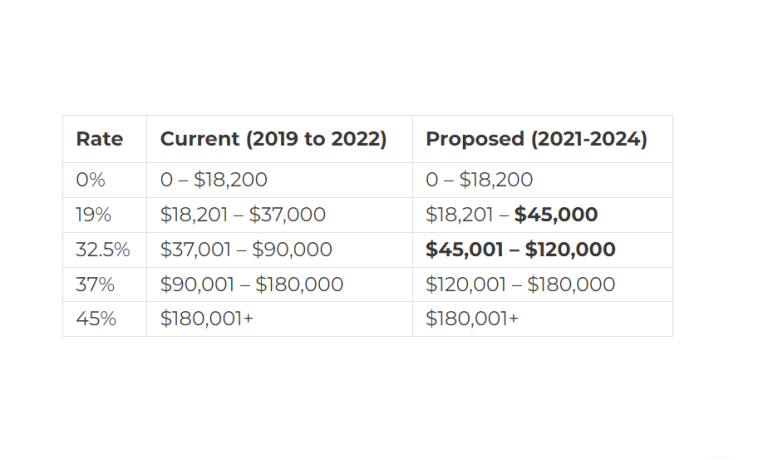

The personal income tax rate changes that have already been legislated, effective from 1 July 2024 (i.e., from the 2025 income year), remain unchanged. These involve abolishing the 37% personal income tax bracket, reducing the 32.5% personal income tax bracket to 30%, and increasing the upper threshold of the reduced 30% tax bracket from $120,000 to $200,000.

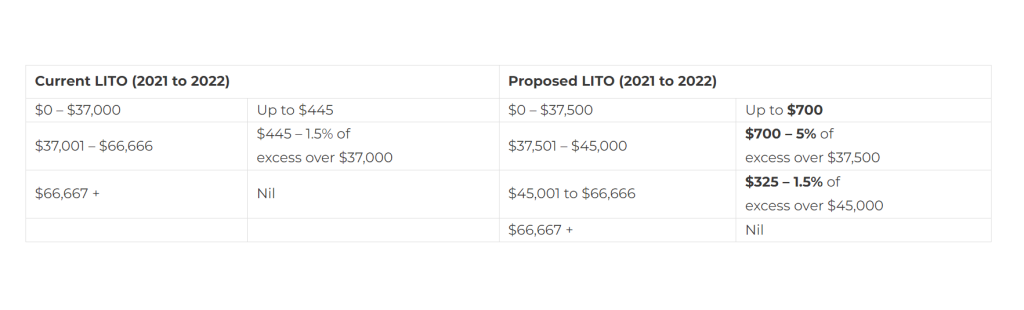

The current Low and Middle Income Tax Offset (‘LAMITO’) would continue to apply for the 2021 income year (which is available in addition to the LITO for eligible taxpayers). For example, the maximum LAMITO of $1,080 will be available to taxpayers with taxable incomes of between $48,000 and $90,000 in the 2021 income year.

The Government has announced that it will expand the concessions available to Medium Sized Entities to provide access to up to ten Small Business Concessions.

For this purpose, a Medium Sized Entity is an entity with an aggregated annual turnover of at least $10 million and (less than) $50 million.

- From 1 July 2020, eligible businesses will be able to immediately deduct certain start-up expenses and certain prepaid expenditure.

- From 1 April 2021, eligible businesses will be exempt from FBT on car parking and multiple work-related portable electronic devices, such as phones or laptops, provided to employees.

- From 1 July 2021:

- Eligible businesses will be able to access the simplified trading stock rules, remit pay as you go (PAYG) instalments based on GDP adjusted notional tax and settle excise duty and excise-equivalent customs duty monthly on eligible goods.

- Eligible businesses will generally have a two-year amendment periodapply to income tax assessments for income years starting from 1 July 2021.

- Businesses with an aggregated annual turnover of less than $5 billion will be able to claim an immediate deduction (what the Budget terms as ‘full expensing’) for the full (uncapped) cost of an eligible depreciable asset, in the year the asset is first used or is installed ready for use.

- The period in which such assets must first be used or installed ready for use will be extended by 6 months, until 30 June 2021.

Companies with a turnover of less than $5 billion can now carry back losses from the 2020, 2021 or 2022 income years to offset previously taxed profits made in or after the 2019 income year.

This will allow such companies to generate a refundable tax offset in the year in which the loss is made. The tax refund is limited by requiring that the amount carried back is not more than the earlier taxed profits and that the carry back does not generate a franking account deficit.

Meetings conducted via virtual attendance

In order to reduce regulatory barriers, the Government will undertake public consultation on making permanent changes to the Corporations Act 2001. These changes would allow companies to call and conduct meetings electronically (with a quorum achievable through virtual attendance of shareholders and officers) and also to provide certainty that company officers can electronically execute a document.

From 2 October 2020, the Government will introduce an FBT exemption for retraining and reskilling benefits provided by an employer to redundant, or soon to be redundant employees, where the benefits may not be related to their current employment (e.g., where an employer retrains a sales assistant in web design in order to redeploy them to an online marketing role in the business).

This measure is designed to encourage employers to assist redundant workers to transition to new employment opportunities within or outside an employer’s business, without triggering an FBT liability.